Sole Proprietor Tax Rate in Malaysia: How to Reduce Income Tax

- Chow Ping

- Oct 13, 2025

- 5 min read

Updated: Oct 30, 2025

As a Sole Proprietor in Malaysia, every Ringgit you earn goes straight onto your personal income tax bill.

There's no clever accounting trick to avoid this. No separate "company profits" that sit safely in a corporate account.

Your business makes RM10,000? That's RM10,000 added to your personal income.

Your business makes RM500,000? Congratulations, you're now in the highest tax brackets.

The more successful your business becomes, the more LHDN takes.

Fortunately, there are legal, proven ways to reduce your tax burden as a Sole Proprietor in Malaysia.

Today, we'll talk about...

• what a Sole Proprietorship is, how the tax rates work

• three strategies to keep more of your money

What is a Sole Proprietorship?

Think of a Sole Proprietorship like wearing a mask.

You're still YOU running the business, just under a different name.

There's no separation between you and your business. You ARE the business.

This means:

All your business profit = your personal income

Higher profits push you into higher tax brackets

You pay tax on everything (even money you put back into the business)

You're personally responsible if something goes wrong

Business debts become your personal debts

The good part?

Simple setup and low compliance costs

Lower tax burden when profits are small

You keep full control (no shareholders, no board meetings)

Minimal paperwork compared to a Sdn Bhd

A Sole Proprietorship is perfect if you're just starting out, testing a business idea, or running a low-risk service business like consulting or freelancing.

But as your income grows, so does your tax bill. Until a point where it makes more sense to incorporate as a Sdn Bhd. More on that later.

Right now, let's talk about how sole proprietor tax rates work in Malaysia works.

How Sole Proprietor Tax Rates Work in Malaysia

As a Sole Proprietor, you file Form B with LHDN (not the regular Form BE that salaried employees use).

The deadline is June 30 every year.

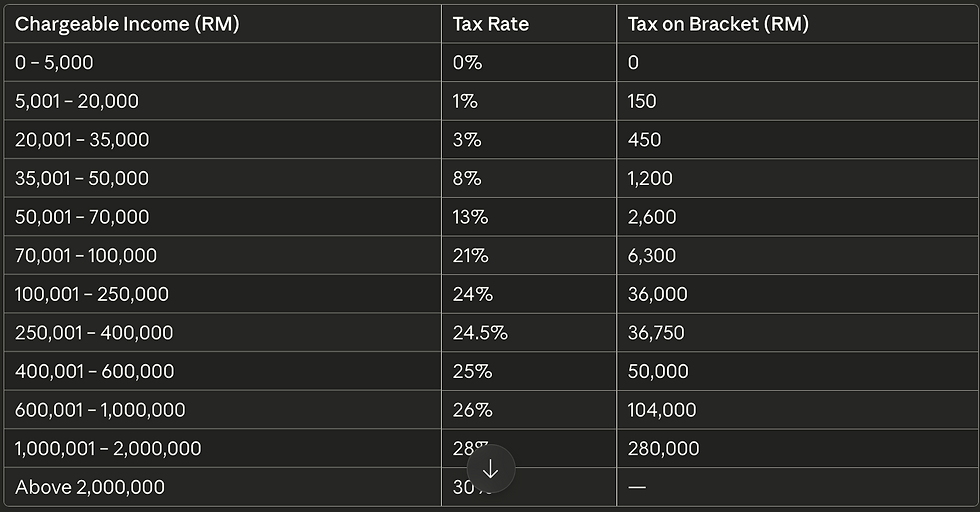

Here are the personal income tax rates that apply to your business profits:

Look at those rates above RM100,000.

Once you cross RM100,000, LHDN starts taking a much much much much muccchhh bigger bite.

Fortunately, LHDN is 100% a monster, because you don't pay the highest rate on ALL your income.

Malaysia uses marginal tax rates, which means your income is taxed progressively across multiple brackets.

Let’s say you run a successful cat massage business.

The cats love you. They all leave 5 start reviews on your page. As a result, business blooms.

You make RM200,000 in chargeable income.

However, you don’t pay 24% on the entire RM200,000, which would be RM48,000 (OUCH).

What does happen is this:

First RM5,000: 0% = RM0

Next RM15,000: 1% = RM150

Next RM15,000: 3% = RM450

Next RM15,000: 8% = RM1,200

Next RM20,000: 13% = RM2,600

Next RM30,000: 21% = RM6,300

Final RM100,000: 24% = RM24,000

Total final tax: RM 34,700

It’s money, but less painful than RM48,000.

Too confusing? No problem. We'll handle it all for you.

Now let's talk about how to reduce that tax bill even further.

3 Ways to Reduce Your Sole Proprietor Tax

1. Claim Every Legitimate Business Expense

This is the foundation.

Every legitimate business expense you claim reduces your taxable income.

What qualifies:

Employee salaries

Insurance premiums

Office supplies and equipment

Office rent or home office deduction

Professional fees (accountant, lawyer)

Travel expenses for business purposes

Utilities (electricity, water, internet, phone)

Marketing costs (ads, website, business cards)

Software subscriptions (ClickUp, Canva, ChatGPT Plus)

The golden rule: Keep your receipts.

2. Maximize Personal Tax Reliefs

Even as a business owner, you're entitled to standard personal tax reliefs.

These stack on top of your business expense deductions.

The big ones:

Spouse relief: RM4,000

Individual relief: RM9,000

Child relief: RM2,000 per child

Life insurance/EPF: Up to RM7,000

Lifestyle purchases: Up to RM2,500

Education fees (self): Up to RM7,000

Medical expenses (parents): Up to RM8,000

If you're in the 24% bracket, a RM10,000 relief saves you RM2,400 in actual tax.

Make sure you claim all of these.

3. Convert to Sdn Bhd when the time is right

Here's where things get interesting.

At a certain income level, staying as a Sole Proprietor means you're being too generous with LHDN.

The Fundamental Difference

As a Sdn Bhd:

Your company pays tax separately (17% on first RM600,000)

You only pay personal tax on salary + dividends you take out

You control withdrawals = you control your personal tax

Your personal assets are protected (limited liability)

But Sdn Bhd comes with costs:

Audit fees: RM2,000-5,000 yearly

Company secretary: RM600-1,200 yearly

Monthly accounting: RM6,000-24,000 yearly

So is it worth it?

Depends on your income.

Consider these two scenarios.

Scenario 1: Sarah the Freelancer (RM 80k yearly profit)

Sarah is a freelancer who makes RM80k profit yearly from her design business.

As a sole proprietor, she pays around RM3k in personal tax.

If she switches to Sdn Bhd?

The company pays RM12k tax (15%).

Plus audit fees, secretary fees, accounting costs... She's actually paying MORE.

Scenario 2: Adam the e-comm king (RM 500k yearly profit)

Adam has an online store that makes RM500k profit.

As sole proprietor, he pays a crazy RM140k+ in personal tax (ouch!).

Switch to Sdn Bhd? Company pays RM85k.

He takes RM200k salary, pays RM26k personal tax.

Total: RM111k.

That's RM29k saved!

(Plus, he sleeps better knowing his house won't disappear if someone sues the business.)

Having said that, Sdn Bhd comes with other costs — the reason Sarah the freelancer would pay MORE money if she registers as a Sdn Bhd.

• Audit fees (RM2k-5k yearly)

• Company secretary (RM600-1.2k)

• Monthly accounting (RM500-2k monthly)

Your cheatsheet

If you're making under RM150,000: Stay as Sole Proprietor. Keep it simple.

If you're making RM150,000-250,000: Run the numbers for your situation. Consider non-tax factors like asset protection.

If you're making RM250,000+: Seriously evaluate Sdn Bhd. You're likely paying too much tax.

If you're making RM500,000+: Convert already. You're being too generous with LHDN.

Conclusion

As a Sole Proprietor in Malaysia, your business profit equals your personal income.

You're taxed using progressive marginal rates, which is better than flat rates but still painful at higher income levels.

And remember: at a certain income level (usually RM250,000+), converting to Sdn Bhd stops being a question and becomes common sense.

The key is knowing when you've reached that tipping point.

At Douglas Loh & Associates, we help Sole Proprietors optimize their taxes and make smart decisions about business structure.

And when it's time to register as a Sdn Bhd, we manage the entire conversion from start to finish.

Want to focus on your business while we manage the boring paperwork for you?

Comments